If I used the same bank for all of these accounts, I suppose I wouldn’t need Mint, but these accounts spread across multiple institutions. I use it to get a quick look at my checking, savings, credit cards, brokerages and retirement accounts.

I’ve yet to find a more straightforward solution to track all of my accounts in one place.

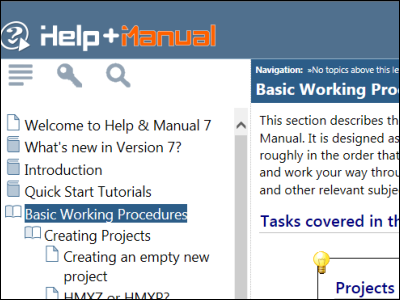

HELP MANUAL IN MONEYSPIRE FREE

The free service, the personal financial aggregator, is great, but what Personal Capital really excels at is tracking every aspect of your investments. There are two elements to Personal Capital: personal financial aggregating and advisory services to manage your finances. Personal Capital provides a view of all your budgeting and investment finances. We hope that this information helps you make the right choice for you. Here are our recommendations for the best way to manage your money via personal finance software. These solutions can help you control your spending and build a savings.Īs we carefully review and try out each of these services, we begin to form opinions as to which we find the most useful as well as those that pack the most punch per dollar. Our Picks For Personal Finance Management Softwareĭid you know that 57% of households don’t have a budget? Planning and following a budget is the first step in personal finance. With his expertise in personal finance, Jeff consults on and reviews our investing and financial content, including this article.

He has a diverse background in small business ownership, accounting and property management. Jeff Butler is our financial guru, holding an undergraduate degree in Finance from Malone University.

0 kommentar(er)

0 kommentar(er)